In the 2020 Retirement Risk Survey, conducted in partnership with Ipsos, the CIA asked Canadians a series of provocative questions about their retirement and long-term planning. The survey focused on how well Canadians understood longevity and life in retirement, and how accurate their expectations are around being disabled in retirement, needing long-term care, and more.

In this article, we look at the key findings associated with questions around long-term care, its costs, and the growing demand.

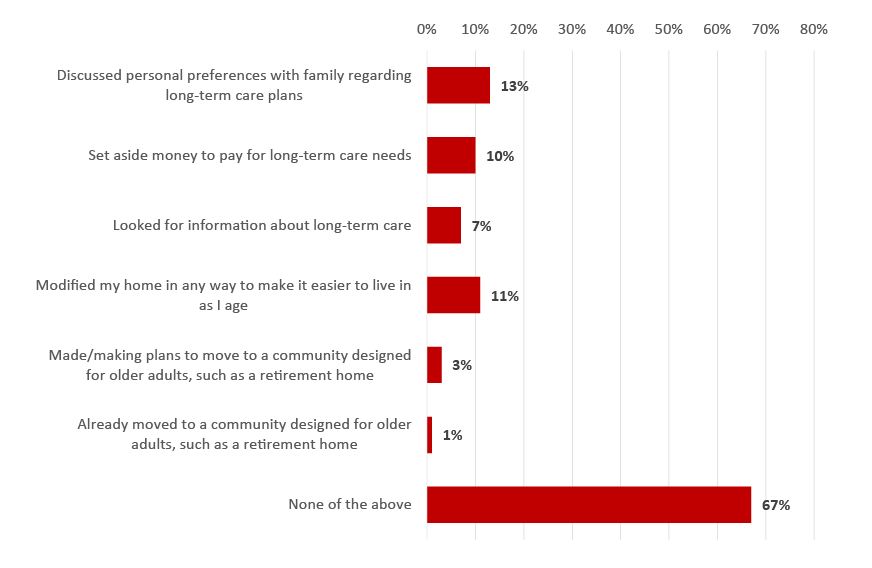

Many Canadians underestimate the risks associated with old age illnesses or the likelihood that they will require long-term care in their later years. A significant number also lack understanding of the costs associated with long-term and in-home nursing care. While some Canadians are planning for their long-term care needs, many more are left unprepared and ill-equipped to face the challenges of aging in retirement.

An underestimated risk

When asked, ‘How likely do you think it is that you will need access to a long-term care facility or nursing home for 24-hour care experience in your lifetime?’, only 22% of Canadians felt they will need access to a long-term care facility or nursing home in their lifetime. But the reality is not so simple.

For most Canadians who live beyond age 80, the proportion needing access to these facilities is much higher (75%). Therefore, understanding and anticipating the costs associated with long-term care is crucial as Canadian’s plan for their retirement. This, however, is not the case. A significant percentage of the weekly costs associated with long-term care living (41%) or in-home nursing care (54%) remain, for many, unknown.

To get a better gauge on the understanding of long-term care costs, we asked respondents to provide their best estimation. Among those that provided an estimate, approximately one in three accurately estimated the average weekly cost of long-term care living (30%) or in-home nursing care (32%). These findings, coupled with 74% of Canadians unsure what, if any, co-payment model for long-term care exists in their province, point to a grossly unaware and unprepared populace.

Availability, quality, and affordability

The impacts of COVID-19 have illuminated the gaps in Canada’s long-term care options, highlighting issues with availability, quality, and affordability.

When asked to give their appraisal of long-term care, 47% of Canadians felt its availability is fair to poor, 55% feel its quality is fair to poor, and 49% rate their ability to afford it as fair to poor. Yet despite this lack of confidence, many Canadians still have not and are not making the necessary preparations to plan in the advent of disease or disability.

Even with the real possibility of illness in old age, the majority of Canadians remain optimistic. 52% of non-retired Canadians expect to live comfortably throughout their retirement, while in contrast, 84% of retired Canadians said they expect to live comfortably throughout their retirement.

Within the 52% overall percentage of non-retired Canadians who expect to live comfortably throughout retirement, there were notable variations in this percentage amongst various subgroups.

Important to note is the significant jump in percentages amongst non-retirees who have a financial retirement plan (75%) and for those who have a balanced investment portfolio (82%).

What do you think about the options for long-term care in retirement? Let us know in the comments below.

Read the full report.

The following comments were shared by readers:

Ellen Whelan: I am concerned about our long term care facilities and their ability to care for the surge in population that will need access to them. Luckily we rely heavily on immigration from communities where home based care via extended families might be more the norm. We need to expand our services for aging at home and in communities rather than just sending people to aging homes! I also believe that a significant portion of the long term care accommodation costs can be covered by an individual’s CPP/OAS payments and therefore begs the question why they need to save in advance to cover these fees? Once entered into a long term care facility, if your drugs are covered by ODB or similar provincial coverage in other provinces, there isnt many other expenses than your semi/private room co-payment.