By Chris Fievoli, FCIA

One of the many outcomes of the recent pandemic was that we had an unprecedented opportunity to take a peek into each other’s homes as we conducted business, which often involved unexpected appearances by our pets. More than a few video calls were interrupted by cats walking across keyboards, or dogs barking when someone had the temerity to ring the doorbell. Participants on calls with me were frequently treated to ongoing wrestling matches between the pug and the golden retriever in my background.

Anyone who owns a pet considers them to be a member of the family, so it makes sense that we want to extend the same protection to them that we have for ourselves and our children. As such, it should not be surprising that a market has developed for pet insurance. What may be surprising, though, is how closely it parallels the products and coverages available to humans.

Between our public health care system, group arrangements and possibly individual health plans, a majority of Canadians have insurance to cover the costs associated with medical treatment. Pet insurance offers the same basic coverage, providing reimbursement for the costs associated with an unexpected accident or illness, including diagnosis and treatment. As someone who used to own a Newfoundland pup, I came to realize that big dogs can come with big vet bills, so I can appreciate the value in having this sort of insurance.

But coverage is not just available for unexpected illnesses. In the same way that dental and vision care plans cover routine examinations and preventative treatment for humans, pet insurance can cover items such as vaccinations, flea treatments and dental cleanings. And like human insurance plans, there need to be restrictions on any pre-existing conditions.

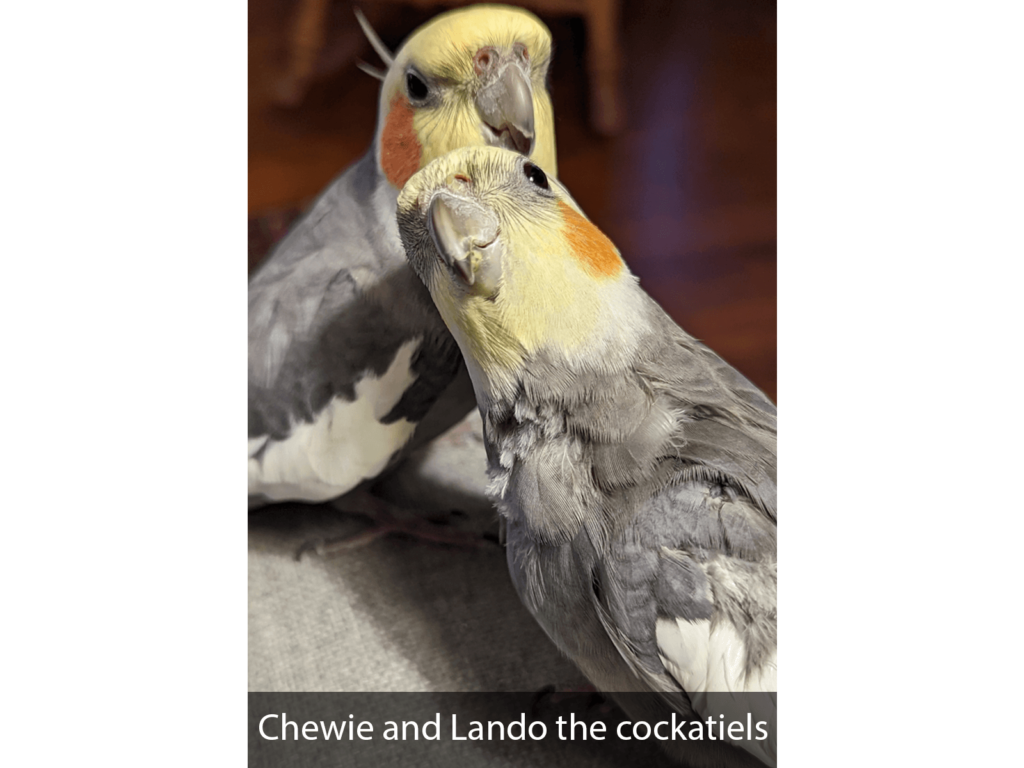

Actuaries are quite familiar with rating factors. For example, life mortality tables will at least be broken down by age, sex and smoking/health status. Pet insurance operates the same way, but with different variables. Considerations include type of pet (dog or cat), age, breed and where the owner lives, along with any other policy options such as level of coverage and/or deductible. Unfortunately, pet insurance is not available for other types of animals, so those of you who own birds, snakes and other creatures are out of luck. (I would not envy anyone who tries to accurately price an insurance product for hamsters.) As far as distribution goes, there is a menagerie (pardon the pun) of ways to find these products. The obvious place would be in veterinary clinics, but insurance can also be found through humane societies, commercial carriers and traditional insurers.

In terms of the product life cycle, pet insurance is still in the early stages of development. There are limited opportunities at this time to apply sophisticated actuarial techniques to the pricing and design of this product. However, like all other actuarial applications, that can be expected to change over time.

The therapeutic benefits of pet ownership are well documented, including improved emotional well-being and lower stress levels (although the latter doesn’t seem to apply when I’m chasing my guys around trying to retrieve a stolen pair of socks). Pet insurance represents another service that the actuarial profession can help provide for the betterment of the public – and their animal friends.

Chris Fievoli, FCIA, is Actuary in Communications and Public Affairs at the CIA.

This article reflects the opinion of the author and does not represent an official statement of the CIA.

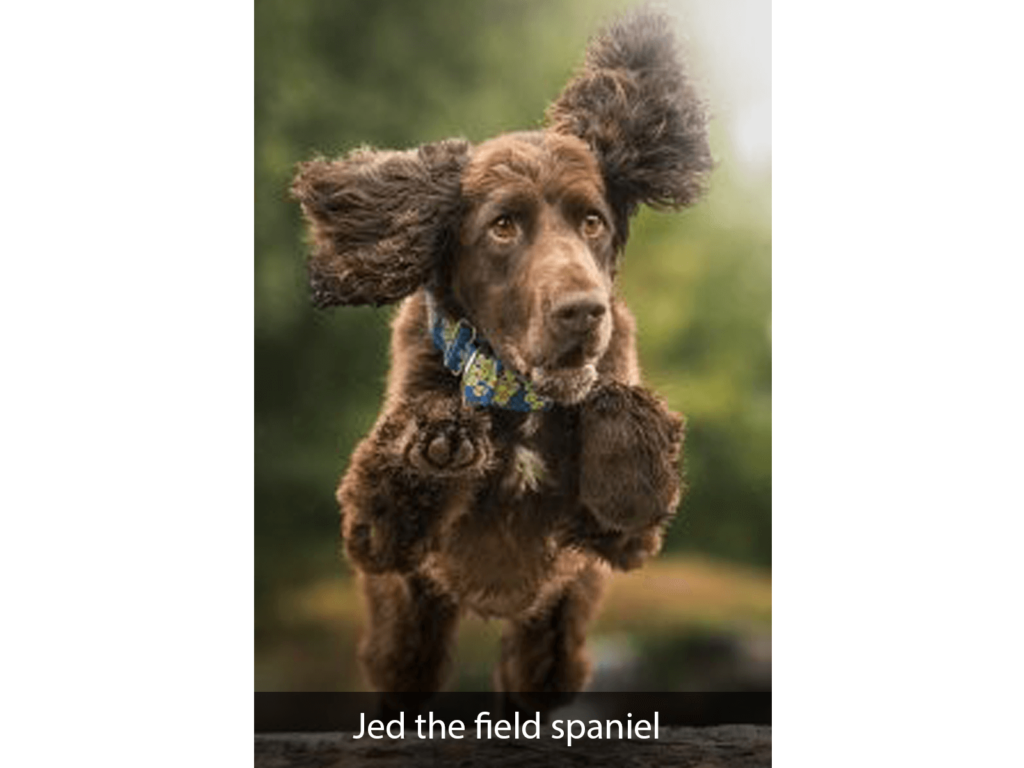

Looking for more CIA pets? Check out a few below!