The Institute used the disruptions of 2020 as an opportunity to bolster education and research efforts on existing and emerging areas of practice – a move reinforcing the relevance of actuarial expertise within and beyond the traditional. From pensions and climate change to enterprise risk management (ERM) and banking, we broadened the bounds, pushing the profession to even further limits.

Pensions: preparing for the future

Approximately 40% of the CIA’s members practice in pensions and retirement, thereby making it a primary area of focus. To this end, the Institute developed and published several resources aimed at heightening awareness around industry changes and advancements.

In July 2020, the CIA and Society of Actuaries released The CPP Take-up Decision, a joint report targeted at better informing the decisions of those for whom delaying Canada Pension Plan (CPP) benefits might provide improved financial outcomes and greater retirement income security.

Of the findings, CIA President Michel St-Germain says: “This research shows that given today’s low-interest environment and general population longevity expectations, delaying CPP payments is a financially advantageous strategy. It is also an excellent example of the CIA’s mission to advance actuarial science and its application for the well-being of society.”

Also released last year were changes to the rules governing the calculation of pension commuted values. Under the guidance of the Actuarial Standards Board, the revised Standards of Practice Section 3000 – Pensions were announced in January and came into effect December 1, 2020.

In a companion episode of Seeing Beyond Risk, Gavin Benjamin, FCIA, and Chair of the designated group overseeing the changes discussed the updates, elaborating on the drivers behind the revisions and how the new calculations are applied.

The CIA also developed a factsheet titled Pension Commuted Values – a resource providing readers with a high-level overview on:

- making estimates to determine a commuted value;

- ensuring commuted values calculations are fair and consistent; as well as

- recent updates to calculations.

Climate risk: time to act

With the recognized importance of climate risks in influencing investment choices, actuaries not only have the expertise but also the responsibility to help assess these risks and gauge their repercussions. For the Institute, this means ensuring our members have the materials and resources needed to stay in the know.

To measure the range of climate change awareness and practitioner needs among Canadian actuaries and their respective companies, the CIA Climate Change and Sustainability Committee (CCSC) issued a survey to members in 2019 and 2020.

“We wanted a better understanding of what members need in terms of information or guidance that could come from the Institute regarding the risks of climate change,” says CCSC member Christine Bisson-Roberge, ACIA.

The results showed that less than one-third of respondents or their companies account for this emerging risk. However, most respondents agree that guidance and education about the materiality of climate change risks may help with this type of risk disclosure.

Bisson-Roberge expands on the 2019 survey findings in a Seeing Beyond Risk podcast, explaining “the survey indicates a lack of understanding and application of the impact of the risks of climate change in all actuarial practices, so it is a top priority to develop actuarial guidance.”

“We wanted a better understanding of what members need in terms of information or guidance that could come from the Institute regarding the risks of climate change.”

Christine Bisson-Roberge, ACIA

Prompted by these insights, the CCSC is committed to addressing the gaps in knowledge, information, and guidance through better communications to members on the topic via a new practice resources document and webcasts over the coming year.

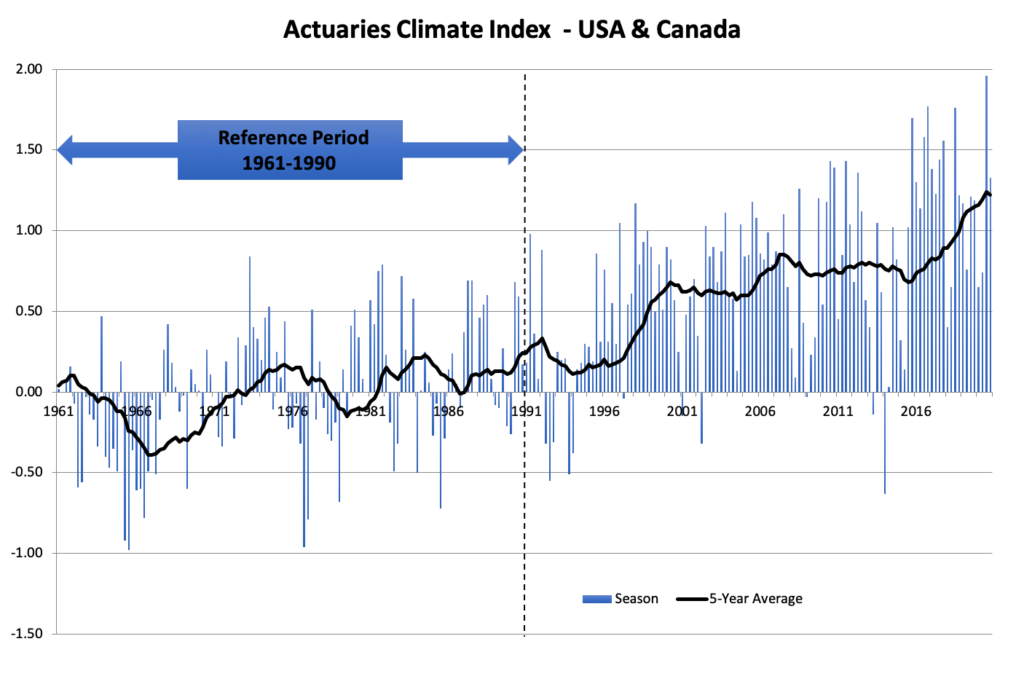

Another valuable contribution of the Institute in this area is the quarterly data release of the Actuaries Climate Index (ACI), an educational tool designed to help inform actuaries, policy-makers, and the public about climate trends in Canada and the US.

Throughout 2020, the five-year moving average continued to chart new highs for ten consecutive quarters, an outcome that poses increased variability to market risk. The importance of this data positions the ACI as an aid to inform policy and evaluate the climate-related impacts on business.

Global insurance regulators are urging the industry to better understand and manage the financial risks associated with climate change, and Canada is beginning the process as well.

The CIA issued its support for Canada’s eight leading pension funds in their call for companies to strengthen their environmental, social, and governance (ESG) disclosure in line with a framework such as that proposed by the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures.

“As Canadian businesses and governments work to rebuild the economy, this is the right time to introduce transparency in financial reporting mechanisms and disclosure requirements,” says CIA President Michel St-Germain. “Improved disclosure and common standards for financial reporting is a move that allows actuaries to better assess the financial impacts of ESG risks on insurance companies and pension plans now and far into the future.”

ERM and banking: marking our place

Adaptation requires risk and for actuaries that might look like entering non-traditional areas of practice such as banking or ERM.

No longer limited to assessing financial risks, ERM now analyzes newer threats of impact on business (reputational and operational risk) – and organizations are calling on actuaries to assist.

From mitigating risk as it happens to building a pandemic response team, COVID-19 is just one area where we have seen the practical ways actuaries are applying their modelling expertise to provide insights and solutions.

Another offshoot to this area is predictive analytics and the notion that data science and actuarial science, both multidisciplinary in approach, are more the same than different. By highlighting their similarities, we see how both disciplines require practitioners to have a strong understanding of underlying business processes and domain knowledge to be successful at accomplishing tasks. Honing a deeper understanding of data science can allow actuaries to leverage its results in their work and find more applications for its use.

Banking is another area of high opportunity for actuaries. With traditional banking models under increasing threat, the demand for actuarial expertise grows. Yet closing the gaps remains a challenge.

As one of the fastest emerging areas of practice for the Canadian actuarial profession, our objective is to equip members with the tools and information needed to integrate. One such effort is the getting into banking webpage – a resource list of materials collated by practitioners for those interested in learning more about how actuaries are adding value and developing careers in banking.

The Actuarial Students National Association (ASNA) has been pivotal in this campaign, featuring the informational session on actuaries in banking at the 2021 ASNA convention. Using real-life examples and discussion, the session demonstrated how traditionally developed actuarial skills, knowledge, and concepts are being used more widely in emerging areas.

The transferability of actuarial skills in business is undeniable. Applying the profession’s expertise in risk mitigation can allow actuaries to take advantage of existing cracks and exploit risk opportunities for the betterment of any organization, regardless of sector.

IFRS 17: bracing for change

In 2023, Canadian insurers will join the rest of the world in applying the new standards to financial statements. In preparation for this significant change, the Actuarial Standards Board and numerous groups within the CIA have been working diligently to support actuaries through this transition.

The IFRS 17 blog (login required) has been an invaluable tool in this outreach, serving as a repository for all things IFRS 17, including educational notes, links to websites, and updates from CIA committees.

Several sessions held during act20, the CIA’s annual flagship event, explored topics such as:

- Practical considerations of variable annuity risk management under IFRS 17

- The impact of IFRS 17 on the role of the actuary

- IFRS 17 – Challenges for actuaries in future audits

- IFRS 17 evolving guidance

The Institute also met with regulatory agencies such as the Office of the Superintendent of Financial Institutions and Autorité des marchés financiers to ensure a common understanding of how IFRS 17 will be implemented. The updated IFRS 17 will likely result in additional implementation challenges, but it is important for insurers to press forward. With the appropriate internal and external resources dedicated, we are confident companies and actuaries will be well prepared to begin reporting under IFRS 17 in 2023.

This is the fourth of five articles from Together, Apart: the 2020-2021 CIA Annual Report. Read the third article, Actuaries’ expertise at home and abroad, now. Watch for the next article, Contributing to a public-focused profession, coming soon.