By Marie-Josée Vandal, ACIA

Until very recently, the emphasis on defined contribution (DC) pension plans has been on the accumulation phase. However, this phase represents only about half of the time participants are investing their money. Once they retire, just as their accumulated assets peak, participants are left to fend for themselves. As we say, they “fall into retirement” – and sometimes quite hard.

More and more pension plan participants are entering the decumulation phase of their lives, with a significant proportion of their retirement assets in a DC plan or savings plan such as an RRSP. Is there a way they can continue to reap the benefits of pooling assets for this second phase of their financial life? Some DC plan sponsors are currently addressing the issue and considering adopting solutions. These actions can improve their plans, often with no additional costs, and provide them with a new tool for managing their workforce. Current legislative changes also favour this thinking.

Legislative changes and variable benefits

Legislation at the federal level and in most provinces now allows the payment of retirement income directly out of a DC plan. In Québec, this has been allowed since January 2018. Ontario followed in 2020 and this is now permitted in all jurisdictions except New Brunswick and Newfoundland & Labrador. Pension plan sponsors therefore have a duty to consider new decumulation options.

In addition, two new types of annuities are now allowed under the tax rules for registered plans. The first type allows the payment of variable payment life annuities (VPLAs). The second one allows for an advanced life deferred annuity (ALDA) beginning, at the latest, at the end of the year when the age of 85 is reached. This vehicle is also recognized as a qualified investment under an RRSP, a registered retirement income fund (RRIF), or a DC plan.

Thus, in addition to the usual vehicles used for decumulation, such as RRIFs and life income funds, the arrival of VPLAs and ALDAs now allow participants to better protect themselves against the risk of longevity.

Solutions

Providers must offer tailored solutions to meet the needs of pension plan sponsors and their members. The culture of the employer’s organization plays an important role, with a fear of increasing fiduciary obligations acting as a potential constraint on the employer. Here is an overview of possible solutions, ranked from lower to higher levels of fiduciary risk:

- The service provider’s basic market offering: This is the ideal option for an employer who chooses a DC plan to limit its involvement and its risks. The participant has two choices on termination from the DC plan: transfer their assets to the financial institution of their choice or, by default, switch to the service provider’s program (which will offer them a preferential rate).

In the first case, the financial institution offers them individual pricing, which can be more than double or triple the rate charged during the accumulation phase. In the second case (the default option), although their assets are pooled within the supplier’s program, the participant likely does not benefit from pricing as advantageous as that offered in the employer’s plan during the accumulation phase, but still often more advantageous than on an individual basis. We know that a reduction of a single percentage of costs during the decumulation period (for example from 2.5% to 1.5%) can increase the duration of income by more than four years and thus reduce the risk of the participant outliving their savings.

- A personalized solution: For this second solution, the process is similar to the accumulation phase, but with the addition of retirement vehicles and a choice of funds adapted for participants during the decumulation stage. Advantageous fees are also negotiated for these participants. When good governance is already in place, experience shows that it is relatively easy for the provider to offer this affordable and user-friendly decumulation solution.

For the employer, this is a way to improve their plan at no additional cost. Some additional fiduciary obligations are required, but they are not onerous if an adequate monitoring structure is in place for the accumulation phase. For the participant who arrives at retirement, the transition is more harmonious, and they continue to benefit from advantageous fees. In fact, all participants will benefit because insurers set their rates according to total assets, and at retirement the participant’s assets are generally the highest. The adoption of a decumulation solution therefore has a positive impact on all stakeholders.

- Variable benefits: For this third solution, variable benefits are offered directly from the DC plan. The member remains in the plan since the sponsor has the option of paying the retirement income directly out of the DC plan. There is continuity in terms of services, particularly regarding the tools offered to participants. For fund selection, as for the personalized solution described above, participants can also benefit from the employer’s expertise, while the fees are the same as during the accumulation phase. On the sponsor’s side, fiduciary responsibility is slightly increased regarding certain administrative tasks and, as with the personalized solution described above, monitoring during the decumulation period.

Financial well-being

Some of the solutions presented above can have a direct impact on the financial well-being of employees. It is well known that there is a strong link between a person’s financial well-being and their health and productivity at work.

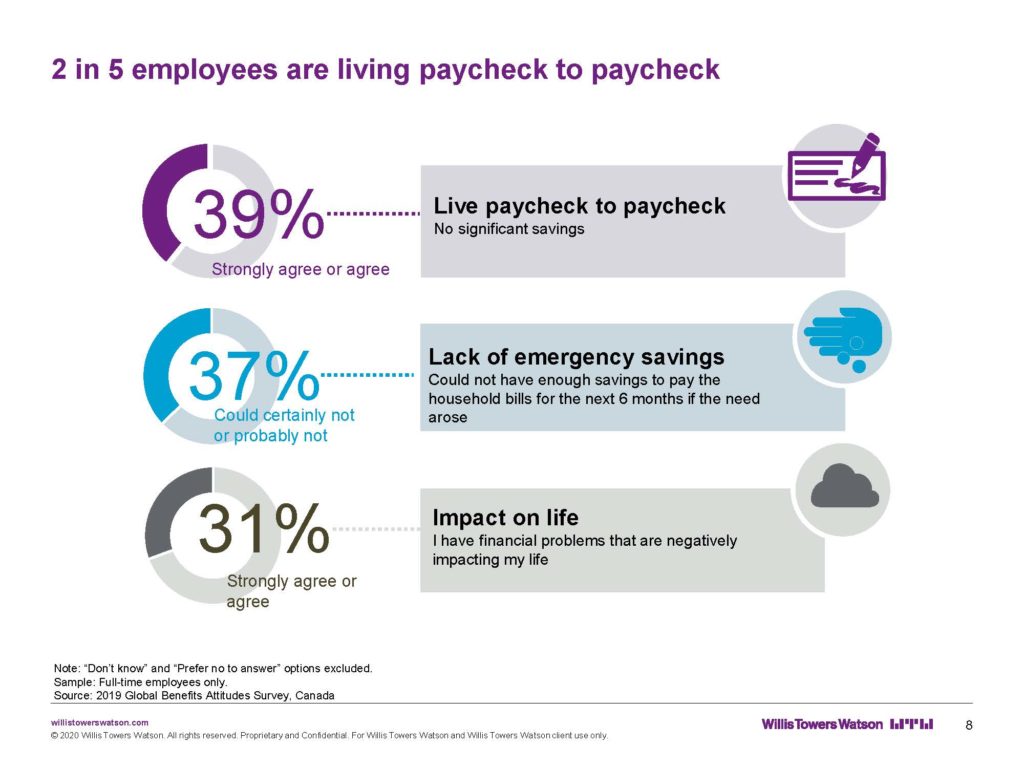

According to Willis Towers Watson’s Global Benefits Attitudes Survey, 39% of employees live paycheck-to-paycheck, and of this group, 49% have very little financial literacy. Among all respondents, 37% say they don’t have an emergency fund and 31% say they experience financial challenges impacting their life.

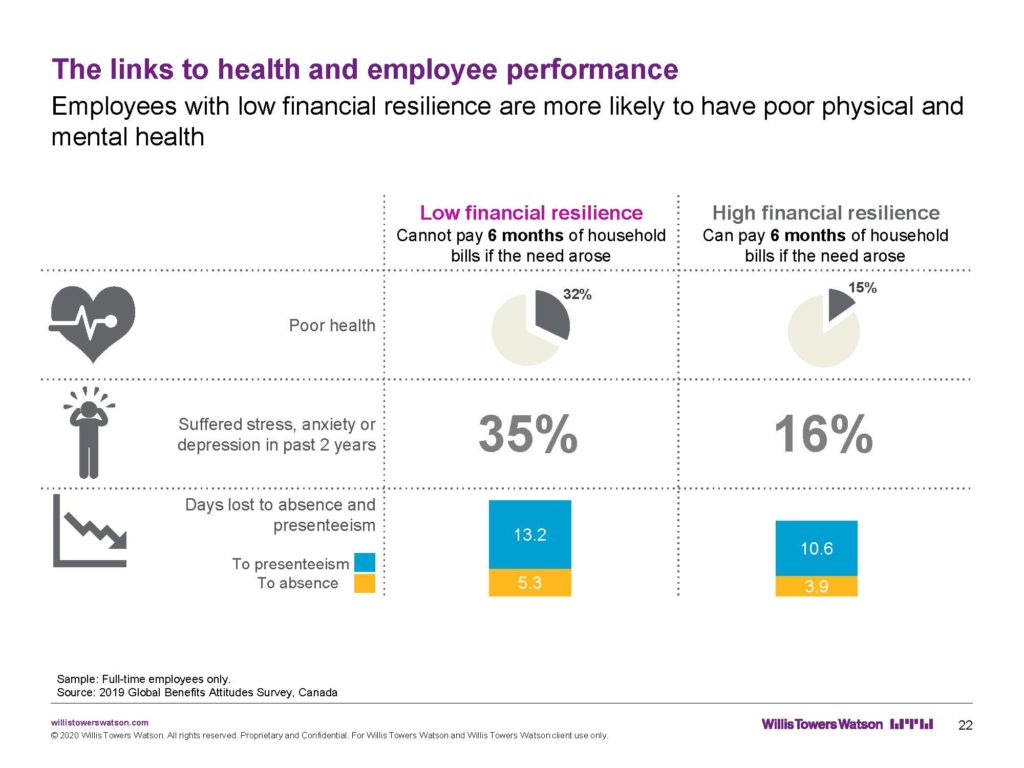

There is a higher rate of presenteeism and absence from work among employees who experience anxiety about their financial security. For people with a resilient financial situation, meaning that they have sufficient savings to meet their financial obligations for six months, there is a difference of four days of absence less per year compared to people who are less financially resilient. Those with low financial resilience are also twice as likely to have experienced stress, anxiety, or depression in the past two years.

While these numbers are worrying, they do indicate that greater financial security among plan members can translate into improved job performance. Some decumulation solutions can help address workforce management issues such as presenteeism and absenteeism. Additionally, in a context of labour shortages, organizations that offer attractive solutions will more likely have an impact on employee retention. From this perspective, the decumulation stage certainly represents an opportunity to be seized.

The following comments were shared by readers:

Shannon Patershuk: This article addressees a need that has been unfulfilled during the decumulation phase of retirement planning. It is encouraging to see that solutions are being legislated and supported by the industry. Hopefully employers can use the pooling of DC plans after retirement to attract and retain employees as well as help to create a healthy retirement lifestyle for retired employees. An article outlining the options for existing retirees would be most interesting.