By DENIS GARAND, FCIA, DONNA SWIDEREK, ACIA, JULES GRIBBLE, FIAA

About 4 billion of the world’s current 9 billion people may benefit from inclusive insurance initiatives, but this potential market may not be easy to access from a traditional insurance perspective.

This leaves a large group of people without access to insurance who, with access, could improve their lives by utilising formal inclusive insurance products – not only for recovery of losses from adverse events – but also to provide the confidence to take risks to advance their economic growth. Inclusive insurance products are relevant to economically disadvantaged groups in all countries, so it is incorrect to presume that these products are only applicable in countries with relatively low average incomes.

In Canada, 76% of the population (29 million people) had life or supplementary health insurance coverage in 2021 (CLHIA 2022). The majority (66%) of those with coverage had coverage through group plans. 22 million Canadians were covered for life insurance, 27 million had supplementary health insurance coverage and 12 million Canadians were covered for disability through Canadian insurers. This leaves an important portion of the population not covered for large financial shocks from risk events such as death or disability.

Canadians without group coverage through their employer, contract workers, the “gig” economy and new Canadians among others may be without access to insurance. The characteristics of these segments of uncovered Canadians are similar to the characteristics of those accessing inclusive insurance internationally – they have variable incomes and are not affiliated with a group or association offering insurance.

Many major insurance providers are now working on delivering commercially viable inclusive insurance products in many countries. There has been a steep learning curve for these providers, as they need to understand the inherent differences between inclusive and traditional insurance provisions.

The International Actuarial Association’s (IAA) Risk Book chapter on inclusive insurance provides a high-level introduction to inclusive insurance and how this type of insurance differs from traditional insurance as typically taught in actuarial qualification syllabuses.

The IAA Risk Book

The IAA is the global body representing the actuarial profession and its Risk Book introduces actuarial topics, in an accessible way, to a wide audience including users of actuarial services, actuarial students, the wider business and regulatory community and actuaries. Actuarial advice to businesses, policy decision-makers and supervisors can give them insight into the potential of future risk events by quantifying financial impacts and supports them in making better business decisions.

The Risk Book’s inclusive insurance chapter, published in 2021 (IAA 2021) introduces inclusive insurance. Here are some highlights from it and we encourage you to read it for yourself. The full Risk Book is also available from the IAA website.

What is inclusive insurance?

The Risk Book chapter defines inclusive insurance as insurance products through which adults have effective access to insurance and savings products offered by insurers through formal providers. Effective access is explained as the involvement of convenient and responsible service delivery, at a cost affordable to the customer and sustainable for the provider, which results in financially unserved or underserved customers using formal financial services rather than existing informal options.

Inclusive insurance products include all insurance products aimed at unserved or underserved markets. These markets typically are insurance markets in developing countries (from an insurance perspective) but are not restricted to such countries. Microinsurance is a subset of inclusive insurance focussing on lower income populations.

It is well established that increased access to inclusive financial services, including insurance, helps to reduce poverty and improve social and economic development. It is also the case that insurance of all types not only provides protection coverage for adverse risks but also provides the confidence to undertake riskier commercial activities, playing both a positive social and economic incentive role and providing security in adverse circumstances. These supports are especially valuable to those living near the poverty line, as one adverse event risks pushing them permanently below the poverty line.

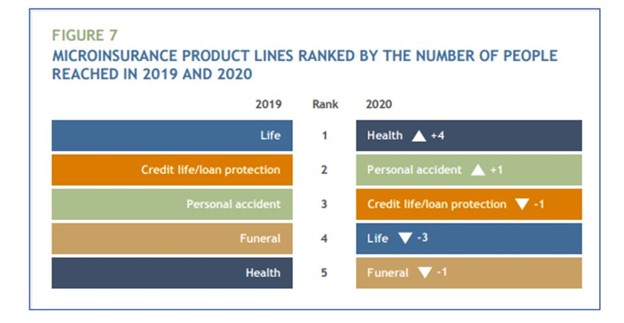

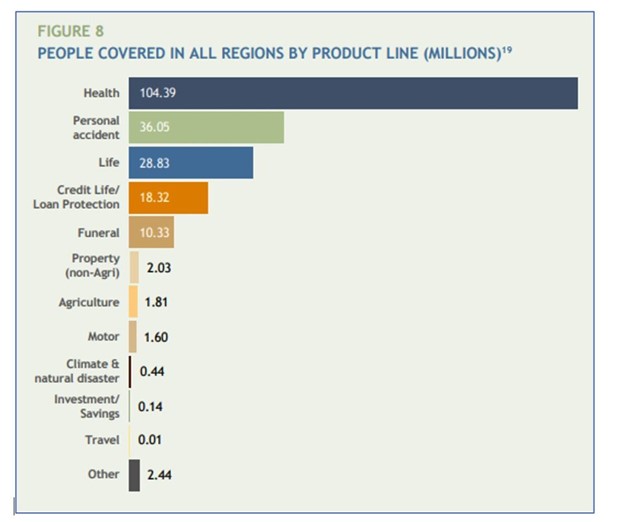

The inclusive insurance landscape is evolving rapidly. A recent global survey (MIN 2021) reinforces this point, as illustrated by the following two diagrams.

The increased prominence of health insurance in product lines, with its ranking moving from fifth to first, is notable and is a change to the historical dominance of life and credit life insurance. The growth in health insurance is primarily due to growth in hospital cash products.

Differences between inclusive and traditional insurance

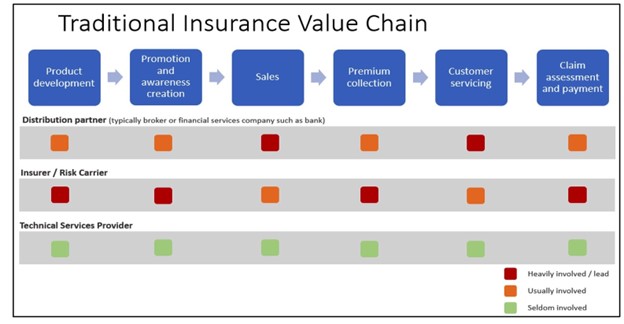

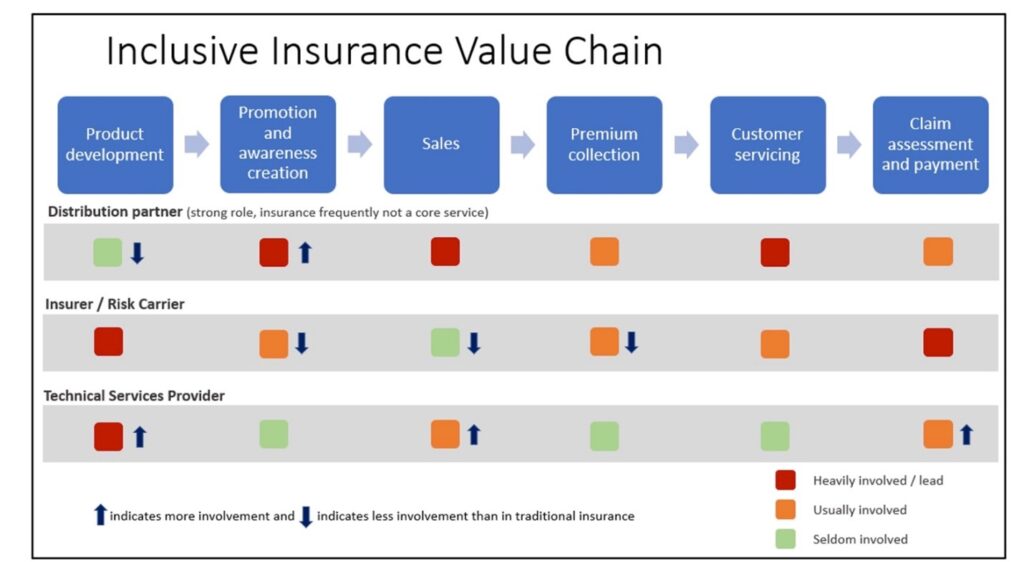

At a high level, there are three key roles in the insurance value chain:

- Distribution partner: Any player that has a role in the distribution of insurance. There may be several distribution partners working together or sequentially to distribute insurance to the customer.

- Insurer or risk carrier: Any party that accepts financial risk in return for payment of the insurance premium.

- Technical services provider (TSP): Provides technical services to a distribution partner, insurer or any other party in the insurance value chain. These services can include actuarial services, technology and data services, international development services or country and market-specific knowledge on how to reach a type of consumer. TSPs are often the “glue” that holds the multiple partners of an inclusive insurance initiative together.

The following diagrams taken from IAA 2021 summarise the significant differences between traditional and inclusive insurance. As these value chains are only indicative, there will be variations in practice reflecting local conditions. The differences and the changes in the importance of various players are highlighted by the arrows in Diagram 2.

Diagram 1: The value chain for traditional insurance

Diagram 2: The value chain for inclusive insurance

TSPs typically play a significantly stronger role in inclusive insurance than in traditional insurance, bringing to inclusive insurance skills and experience that more traditional insurers and distributors may not have. Multiple stakeholders are often involved in delivering key aspects of inclusive insurance, and some of these stakeholders (such as telecommunication companies) may be outside the insurance industry, something that differentiates inclusive and traditional insurance, and often complicates effective inclusive insurance delivery.

Actuarial preconditions

From an actuarial perspective, the differences noted above reflect the context of actuarial work. In traditional insurance markets, a number of preconditions are typically presumed:

- A ready supply of actuaries, the availability of actuarial education and the presence of robust professional standards;

- The availability of relevant, timely and appropriate data;

- Access to systems through which data can be collected and analysed by providers, the industry and at the national level; and

- A regulatory framework that is reasonably well developed and understood by market participants.

In inclusive insurance markets, the reality may well be different and traditional preconditions are frequently not met:

- The supply of actuaries and the actuarial profession may be limited or non-existent. The same applies to other insurance skills;

- Data may not be available or not readily collectable (this could, for instance, lead to a lack of insurance mortality and morbidity tables);

- Systems for collecting and analysing data may not be well developed or integrated;

- Customer understanding of insurance may be limited, especially for first-time customers of inclusive insurance;

- Trust in insurance may be lacking; and

- Regulation that is appropriate for inclusive insurance may not be in place, or conversely, existing regulation may act as a barrier to inclusive insurance.

These issues are discussed further in IAA 2014, and some examples of how these issues could be addressed are given in Blacker 2015.

There is a risk that standard actuarial tools and approaches may not be appropriate in inclusive insurance markets, and that their application may lead to unintended outcomes, such as inappropriate premiums or claims processing.

For more information on the Risk Book inclusive insurance chapter, you can review the chapter itself (IAA 2021) or you can watch two webinars delivered in February 2023 where the IAA reflects on the findings from this chapter (IAA 2023).

Globally, there is a great need for inclusive insurance products. Actuaries can play an important role in the efficient, effective and sustainable delivery of these products. To achieve this, actuaries need to be aware of the differences between traditional and inclusive insurance products, reflecting their environment and their consumers. The challenge for actuaries is how to take traditional actuarial knowledge and transfer it into an environment in which traditionally expected preconditions, actuarially and more broadly, are not met. This will require flexibility and resilience from actuaries and the capacity to apply underlying principles as distinct from standardised “textbook” traditional practices. This challenge is compounded by the need to reflect on the specific circumstances in specific countries.

Jules Gribble, FIAA, CERA, and GAICD (Graduate of Aust Institute of Company Directors)

Jules has been a member of the Australian Institute’s Council (board) for two three-year terms. He represents Australia at the IAA’s Inclusive Insurance Virtual Forum and Risk Book Editorial Board. Until recently, he represented the Australian Institute on the IAA’s Advice and Assistance committee for over a decade. Jules has also been a thought leader on actuarial education in Australia and supervisory capacity building for over 20 years. He is an experienced consultant and a Principal at PFS Consulting who can be reached at julesgribble@pfsconsulting.com.au.

Denis Garand, FCIA, FSA, Actuarial Consultant, Denis Garand and Associates

Denis is a Fellow of both the Canadian Institute of Actuaries and the Society of Actuaries. He has been an independent actuarial consultant since 2001. Previously, he was Vice-President of Group Insurance for a major insurance company. Assignments have included product development and pricing of all group products. Internationally, Denis has advised regulators, government health and health insurance programs and microinsurance organizations in over 40 countries.

Donna Swiderek, ACIA, ASA, Independent Consultant, Denis Garand and Associates

Donna is an Associate of both the Canadian Institute of Actuaries and the Society of Actuaries. She has partnered with Denis Garand and Associates since 2005, primarily pricing and providing actuarial product development research for Canadian group products and supporting the advancement of inclusive insurance through research, training and workshop facilitation in over 15 countries. Her experience also includes 10 years in various corporate actuarial roles in a Canadian insurance company.

References

Blacker J. (editor). 2015. Actuaries in Microinsurance: Managing Risk for the Underserved. ACTEX Publications, Winsted, CT.

Canadian Life and Health Insurance Association (CLHIA). 2022. Canadian Life and Health Insurance Facts, 2022 Edition. CLHIA.

International Actuarial Association (IAA). 2014. Addressing the gap in actuarial services in inclusive insurance markets. IAA.

IAA. 2018. Assessing risk and proportionate actuarial services in inclusive insurance markets — An educational paper and toolkit. IAA.

IAA. 2023. IAA Risk Book: Introduction to Inclusive Insurance. IAA.

IAA. 2023. IAA webinar: The inclusive insurance risk book chapter, Session 1 and Session 2. IAA.

Micro Insurance Network (MIN). 2021. The Landscape of Microinsurance. MIN.

This work is licensed under a Creative Commons Attribution-NonCommercial-No Derivatives CC BY-NC-ND Version 4.0.

This article reflects the opinion of the authors and does not represent an official statement of the CIA.