In the 2020 Retirement Risk Survey, conducted in partnership with Ipsos, the CIA asked Canadians a series of provocative questions about their retirement and long-term planning. The survey focused on how well Canadians understood longevity and life in retirement, and how accurate their expectations are around being disabled in retirement, needing long-term care, and more.

The key findings report penned by FCIAs Anna Doudina, Andrea Kojlak, CIA Staff Actuary Chris Fievoli, Krista Sacrey, and Umair Ali, summarizes the results. This five-part series of articles begins with this summary and then explores the report’s key areas of focus in more detail: impact of COVID-19, retirement age and life expectancy, financial plan for retirement, and living arrangements and long-term care.

“The survey covered a very broad range of topics relating to retirement and long-term planning,” explains Sacrey. “When we started reviewing the data, many of the responses stood out to us because they were unexpected or concerning or both. We’ve constructed the key findings report to call attention to those responses so that the actuarial community can bring their problem-solving skills to bear on some of the underlying issues.”

Top highlights

Despite concerns about the availability, quality, and affordability of long-term care, 67% of Canadians reported not having done anything to plan for their long-term care needs. This is just one aspect with additional concerns around impacts from COVID-19, finances, disability, and more.

1. Impact of COVID-19

When surveyed in the summer of 2020, a significant number of Canadians were already feeling the financial sting of the COVID-19 pandemic. In addition to immediate impacts on household income and debt, COVID-19 is changing Canadians’ planned timeline to retirement and their view of assisted living facilities.

Nearly one in four Canadians (23%) report that COVID-19 has impacted their (or their spouse’s) timeline to retirement. Among those who reported this, the majority (69%) say they will work longer because they need the income. 36% of Canadians report earning less household income due to the pandemic, with higher percentages being seen amongst those born outside Canada (48%), non-retirees (43%), and members of the GenZ generation (58%).

“Canadians need to plan for the future especially with uncertainties like that of COVID-19,” cautions Doudina. “Once you retire you may not have a regular income or it could be much lower, and you may have to rely on other means to uphold your standard of living. For actuaries its natural to look to the future and establish a plan. However, based on the results of the survey, it’s clear that many Canadians need more support to do this.”

We dive further into the impacts of COVID-19 in our next article in the series, COVID-19 shorts Canadians’ plans for retirement.

2. Outliving one’s income

Canadians are showing a tendency to underestimate their life expectancy by almost four years. CIA projections show that Canadians aged 50 (the average age of the survey respondents) can expect to live to age 84.5 ignoring mortality improvement trends, and to age 86.8 when accounting for improvement in mortality over time.

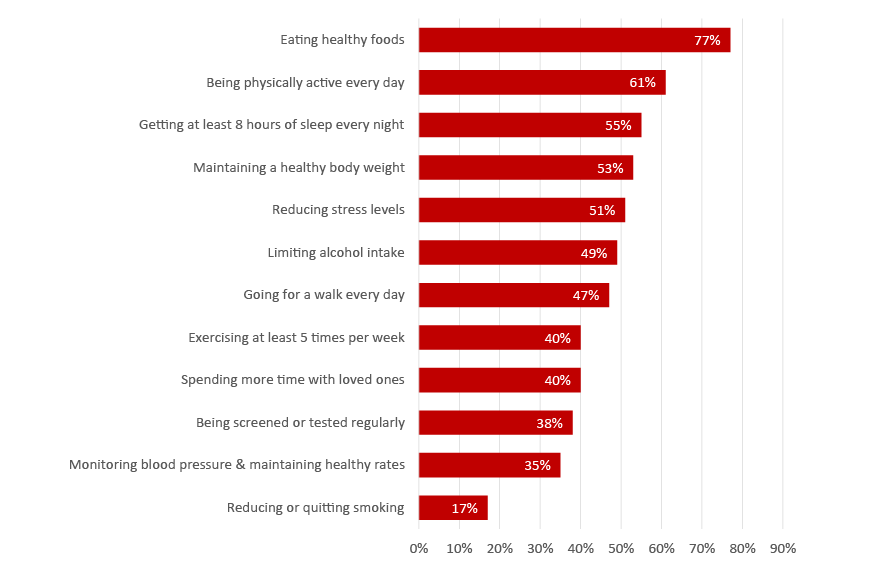

The survey showed that more than 77% of Canadians are taking steps to manage their health, which could contribute to greater longevity. The common steps that Canadians are taking to achieve this include:

Read Outliving one’s income in retirement for a deeper look at how well Canadians’ retirement plans factor in the possibility of living longer and what it might mean for their quality of life.

3. Financial planning

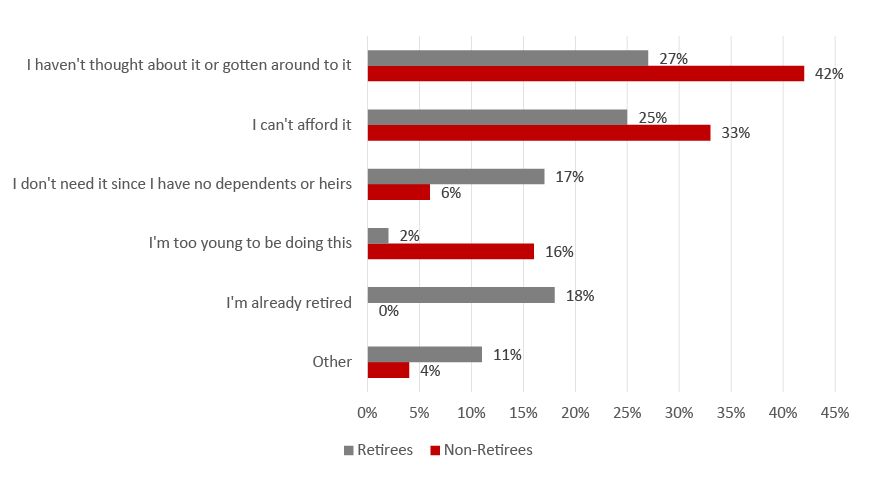

More than half of Canadians do not have a financial plan for their retirement. 80% of those who do have a plan expect to live comfortably in retirement (compared to 44% of those without a financial plan). The reasons for not having a financial plan for their retirement include:

Nearly one in five Canadian retirees (19%) report having less than $25,000 in savings and investments. Assuming 2% inflation and 3.5% post-retirement rate of return for 20 years, the report authors estimate that someone retiring at age 65 would need approximately $900,000 in savings to earn $50,000 in annual retirement income.

Fievoli expands on this: “It’s the question everyone asks: How much do I need to retire? The truth is the answer will depend on each individual’s needs, but we felt it important to do the calculation and provide an example that people can reference to make more informed decisions as they plan for retirement.”

In Financial insecurity is a growing reality for Canadians in retirement, we look at how Canadians are saving for retirement and their plans if their savings are insufficient.

4. Living arrangements and long-term care in retirement

52% of non-retired Canadians expect to live comfortably throughout their retirement. In contrast, 84% of retired Canadians said that they expect to live comfortably throughout their retirement. There were notable variations in this percentage amongst various other subgroups.

Despite being concerned about the availability and quality of long-term care – and their ability to pay for it – only a few Canadians are planning for their long-term care needs.

Only 22% of Canadians feel they are likely to need access to a long-term care facility or nursing home in their lifetime, but for Canadians who live beyond age 85 the proportion needing access to these facilities is much higher (75%).

When it comes to long-term care, 47% of Canadians feel its availability is fair to poor, 55% feel its quality is fair to poor, and 49% rate their ability to afford it as fair to poor.

Read Anticipating the need for long-term care and its costs, to learn how Canadians are preparing, or not, for access to long-term care in their later years.

How actuaries can help

Actuaries, particularly in the pension and insurance area, have an opportunity to be part of the solution. Actuaries can help the general population mitigate these retirement issues by developing more appropriate and accessible financial or insurance products and providing financial literacy and long-term financial planning.

“As pension, insurance and investment experts, actuaries recognize the value in looking at retirement risks and helping people better understand them,” says Ali. “With so many not prepared for the challenges that may lay ahead, it’s time to start a discussion that raises awareness and equips Canadians with the tools to retire with a sense of dignity, confidence, and financial security.”

Tell us about your personal retirement planning, or how you feel actuaries can contribute, in the comments section below.

Read the next article in the series, COVID-19 shorts Canadians’ plans for retirement.

Read the full report.