In the 2020 Retirement Risk Survey, conducted in partnership with Ipsos, the CIA asked Canadians a series of provocative questions about their retirement and long-term planning. The survey focused on how well Canadians understood longevity and life in retirement, and how accurate their expectations are around being disabled in retirement, needing long-term care, and more.

In this article, we explore outliving one’s income in the context of retirement age and life expectancy.

Advances in modern medicine mean people are living longer, and while a longer life is an important gain, it can present a challenge to income security. We asked Canadians to consider how well their retirement plans factor in the possibility of living longer and what it might mean for their quality of life.

A small oversight with a big consequence

The survey results show Canadians tend to underestimate their life expectancy by almost four years. While this assumption may appear negligible, its implications on how Canadians need to plan for a healthy retirement are significant.

CIA projections show that Canadians aged 50 (the average age of the survey respondents) can expect to live to age 84.5, ignoring mortality improvement trends, and to age 86.8 when accounting for improvement in mortality over time.

Significant variations in the gap between reported and projected life expectancies also appear within various subgroups. For example, males underestimate their life expectancy, on average, by 2.9 years while females underestimate their life expectancy, on average, by 4.6 years. As illustrated in the table below, variations in both life expectancy and the degree to which life expectancy might be underestimated can be seen by gender, relationship status, and geographic region.

| Estimated life expectancy at age 50 in years | Survey | CIA projected | Difference |

| All Canadians | 82.9 | 86.8 | (3.9) |

| Subgroups by gender | |||

| Male | 82.4 | 85.3 | (2.9) |

| Female | 83.7 | 88.3 | (4.6) |

| Subgroups by relationship status | |||

| Coupled | 83.9 | 88.2 | (4.3) |

| Not coupled | 81.8 | 84.5 | (2.7) |

| Subgroups by region | |||

| British Columbia | 83.9 | 87.2 | (3.3) |

| Alberta | 82.2 | 86.6 | (4.4) |

| Saskatchewan & Manitoba | 83.7 | 85.8 | (2.1) |

| Ontario | 83.0 | 87.1 | (4.1) |

| Quebec | 82.8 | 87.0 | (4.2) |

| Atlantic | 81.5 | 85.8 | (4.3) |

Furthermore, being healthy while living longer is a crucial factor in longevity.

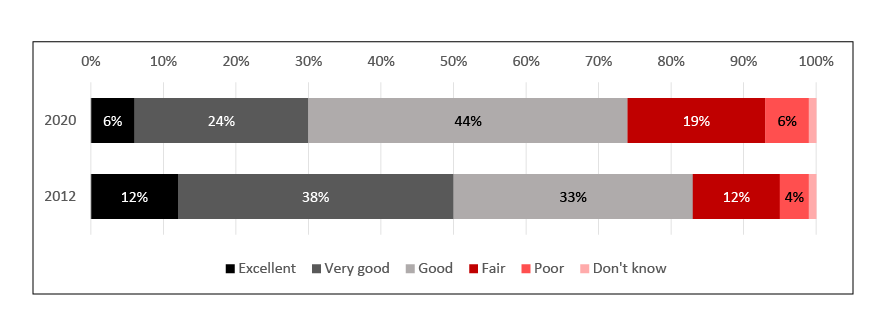

The survey showed that more than 77% of Canadians are taking steps to manage their health, likely contributing to greater longevity. Although that figure is positive, we cannot ignore that overall self-reported health scores have declined significantly since the last CIA survey in 2012. In our current survey, 30% of Canadians aged 45+ report being in very good or excellent health; this figure was 51% in our 2012 survey.

The survey results also took into consideration the impact of the pandemic, revealing that those whose retirement timelines were not affected by COVID-19 anticipate having a longer average life expectancy (83 years) than those whose retirement timelines were affected by COVID-19 (81 years).

We can expect the pandemic’s effect on mortality and morbidity, in both the short and long term, to be a source of scientific and statistical analysis for years to come and an area of research we will continue to monitor closely.

With Canada’s population living longer, coupled with anticipated worker shortages, and the erosion of private-sector pensions, it might be time for federal, provincial, and territorial governments to refresh their approach to helping Canadians achieve retirement income security in old age.

What steps are you taking towards a healthy retirement? Let us know in the comments below.

Read the next article in the series, Financial insecurity is a growing reality for Canadians in retirement.

Read the full report.