Many countries have experienced excess general population deaths in 2020 due to COVID-19, but do excess deaths in the general population translate into additional life insurance claims?

The CIA invited representatives of Canadian life insurance companies to participate on an industry task force to discuss the impact of COVID-19 and consider data collection and analysis to determine if the overall level of life insurance claims in 2020 differ from previous years and if the pandemic is a significant cause of death for insurance claims in Canada. This data and analysis help answer key questions about the impact of COVID-19 on life insurance claims and are useful to actuaries working in group or individual life insurance.

“While the pandemic has been declared for close to a year, many uncertainties remain, and data could be limited. With the aggregate data collected from the industry, actuaries get more data to work with and obtain a more complete picture of the COVID-19 impact,” says Sun Life’s FCIA Salina Young, AVP, Mortality and Longevity Strategic Research.

Insurance claims have increased

Findings from the Canadian Insurance Industry Monthly Aggregate Data Analysis report revealed an increase in individual life insurance claims between April and May 2020, compared to the same period in 2019. This is the first report in Canada using data and analysis to better understand the impact of the pandemic on individual and group life insurance claims.

Salina explains, “The report analyses trends of the overall excess deaths in 2020 relative to 2019. This information is relevant to actuaries, particularly in understanding whether there are significant additional claims from deaths not directly related to COVID-19 (e.g., delayed medical treatments).”

The second report in the series also provides an update based on aggregate data collected from Canadian insurance companies and provides additional data collected up to the end of September. This second part shows more clearly the impact of COVID in the first wave, and the preliminary analysis of how the pandemic impact changed in the summer.

“The CIA and the Canadian life insurance industry report on COVID claims is proving to be helpful to actuaries and is generating tremendous interest in the general public,” says Keith Walter, FCIA and report author. “This was an effective and important collaboration with the life insurance industry during a difficult year.”

Salina specifies, “The aggregate data provides a view of whether COVID-19 is a significant cause of death. This view could be important as actuaries assess the valuation assumptions. Specifically, the survey provides a lens into the pandemic’s impact on the insured population. These insights could help actuaries with the claims monitoring, valuation assumptions review, and stress testing.”

“The aggregate data provides a view of whether COVID-19 is a significant cause of death. This view could be important as actuaries assess the valuation assumptions. Specifically, the survey provides a lens into the pandemic’s impact on the insured population. These insights could help actuaries with the claims monitoring, valuation assumptions review, and stress testing.”

Salina Young, FCIA

Numbers peaked in April

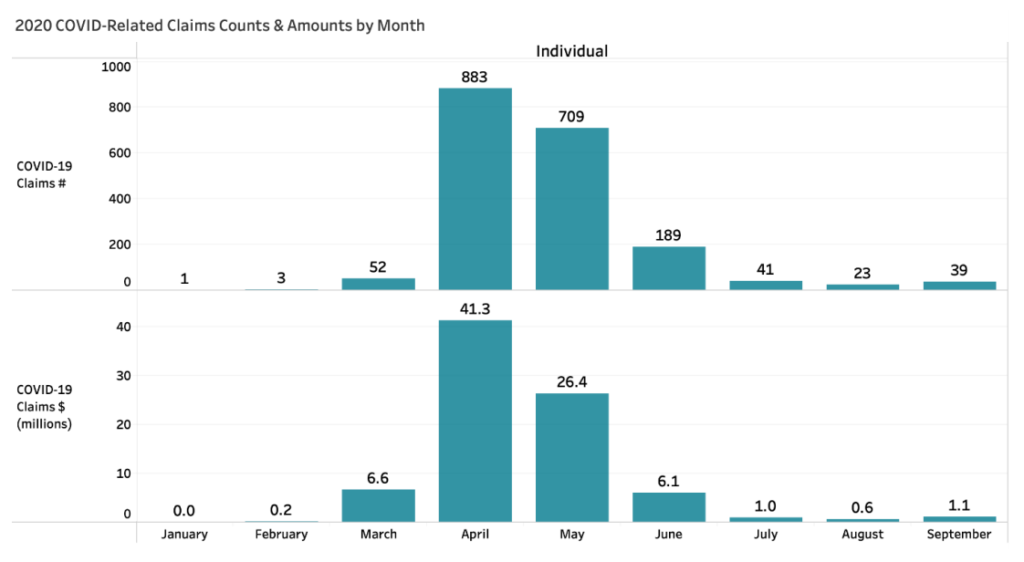

A sample of insurers reporting cause of death identified a total of 1,940 reported individual life insurance claims identified as COVID-19 cause of death.

Numbers peaked in April (see the chart from the report below) with nearly half of reported COVID-19 claims in that month (883 cases, 46%), but COVID-19 related claims continued to be noticeable well into May and June (709 and 189, respectively). Group life insurance claims in 2020 were generally lower than 2019 for the first half of the year; there were a small number of claims identified as due to COVID-19 in 2020 (539 cases).

Although total aggregate monthly group claims in January 2020 were slightly higher than aggregate group claims in January 2019, they were lower in each month from February to June 2020 when compared to the same months in 2019.

In the peak of the COVID-19 impact in April, total COVID-related individual insurance claims were 12.9% of total claims, with 10.8% in May. The ratio for group insurance claims reached a high of 6.2% in April.

Salina explains, “It is generally believed that insured lives are healthier than the general population because of underwriting required for the Individual business and the younger exposure for the group policies. The industry report provides a high-level indication of mortality rate, which could potentially help actuaries understand the difference in impact between insured and general population. Actuaries could then take this information and consider adjusting for the insured experience in the pandemic scenario projection for stress testing purposes, for example.”

As the pandemic runs its course, our collective understanding of the virus and its impact grows with it. Research projects and data, such as the Canadian Insurance Industry Monthly Aggregate Data Analysis, ensures actuaries have the knowledge to understand and manage the impact on business, while fulfilling their roles in risk management and preserving the financial stability of the industry.

Read the full report for data highlights aggregated from 13 insurance companies in Canada from January to June 2020.

The second report is based on additional data collected up to end of September 2020.